Savings accounts

There are several different ways that money can be made to multiply by itself. One of the most popular ones is a savings account.

Most banks offer this extensively and make the access to it as easy as possible. Unfortunately, savings accounts aren’t great investment products, as the interest given is often very low.

Pros

- Very low risk

Cons

- Low interest, money doesn’t grow quickly

Examples

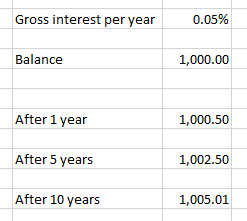

As of today (Nov/2021) one of the largest UK banks offers a savings account with a gross interest rate of 0.05% per year.

Let’s look at what that means in a few years:

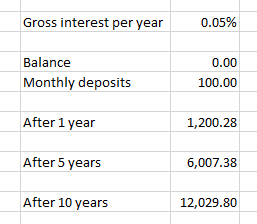

Here is a different scenario, where we start with no balance and have monthly deposits of 100.00:

These are different examples, and both show that the amount of interest that is made by leaving the money alone on a savings account is very little.

Disclaimer

I am not a financial advisor and cannot recommend any financial product or practice.

The information provided on this web site is of a general nature. It is not a substitute for specific advice in your own circumstances. You are recommended to obtain specific professional advice from a professional accountant before you take any action or refrain from action.

Whilst we endeavour to use reasonable efforts to furnish accurate, complete, reliable, error free and up-to-date information, we do not warrant that it is such. We and our associates disclaim all warranties.

The information can only provide an overview of the regulations in force at the date of publication, and no action should be taken without consulting the detailed legislation or seeking professional advice.

Leave a Comment

Your email address will not be published. Required fields are marked *